Key takeaways

- CardMatch is a safe, secure Bankrate tool that helps users get preapproved for a range of credit card offers all in one place.

- In addition to showing consumers which credit cards they may be eligible for, CardMatch also highlights special welcome offers targeted to individuals based on their credit profiles.

- CardMatch places a soft inquiry on your credit reports instead of a hard credit pull, so using the tool will never impact your credit score.

If you’re in the market for a credit card, CardMatch is a great tool to use to begin your search. Easy to navigate and designed to provide personalized offers, CardMatch can give you access to prequalified or preapproved credit card deals and potentially even better bonus offers than those available to the general public.

The best part? CardMatch only triggers a soft inquiry on your credit reports, so it won’t impact your credit score at all. An impact on your score can only come into play if you decide to apply for one of the cards the tool says you’re eligible for.

Since CardMatch is easy to use and may lead you to better card offers, it makes sense to use it each time you plan to apply for a credit card. Keep reading to learn how the tool works and how it can benefit you.

What is CardMatch? The details

CardMatch is a safe, secure service offered by Bankrate that matches users with personalized credit card offers based on their credit profile. The tool can match you with the best credit card offers you have a good chance of being approved for, including targeted introductory bonuses and special incentives.

There’s no obligation to apply for any of the offers you’re matched with, so you’re not committing to anything when you use the tool. CardMatch is also completely free to use.

Try these, too

Bankrate offers additional credit card tools worth checking out, including our:

- Spender Type tool: This tool helps you think about your spending habits and find credit cards that match your profile.

- Card Comparison tool: This tool allows you to perform side-by-side comparisons with up to three credit cards of your choice.

How to use CardMatch

Bankrate’s CardMatch tool is easy to use. Simply follow the prompts and answer the questions to the best of your ability to see personalized recommendations or prequalified credit card offers.

The following steps can help you match with some of the best credit card offers in a matter of minutes.

Step 1. Select your card preferences

EXPAND

The first question you’ll answer is what you’re looking for in a card — whether that is getting cash back, earning points or miles, saving money on interest or building or rebuilding credit. A final option is paying business expenses with a credit card, which you’ll choose if you’re on the hunt for a small business credit card instead of a consumer credit card.

2. Enter basic financial information

EXPAND

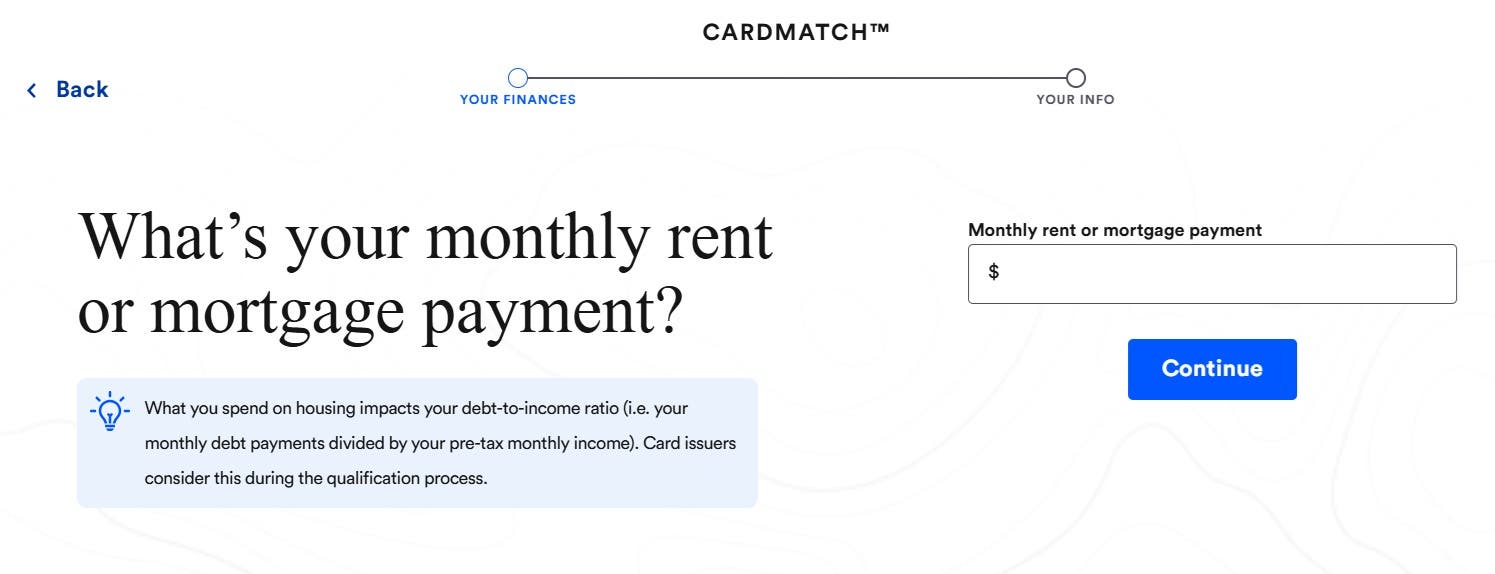

Next up, you’ll be asked for some basic financial information like your employment status, your annual income and your monthly rent or mortgage payment. Bankrate asks these questions because card issuers ask about these aspects of your finances during the credit card qualification process.

3. Enter limited personal information

EXPAND

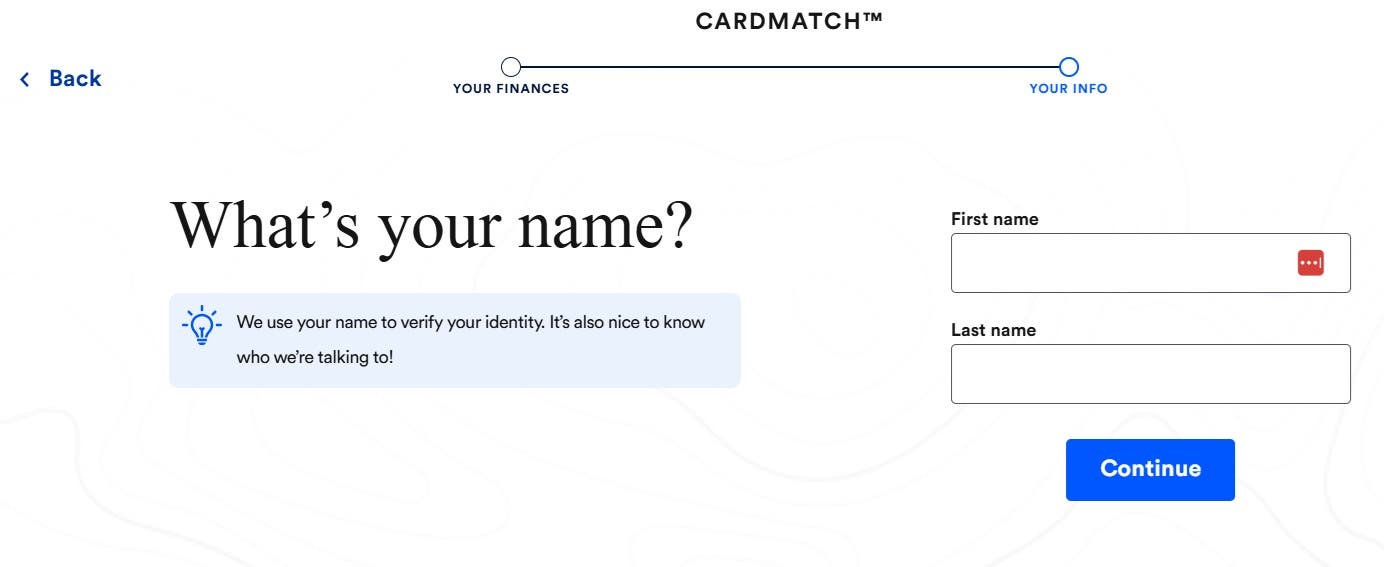

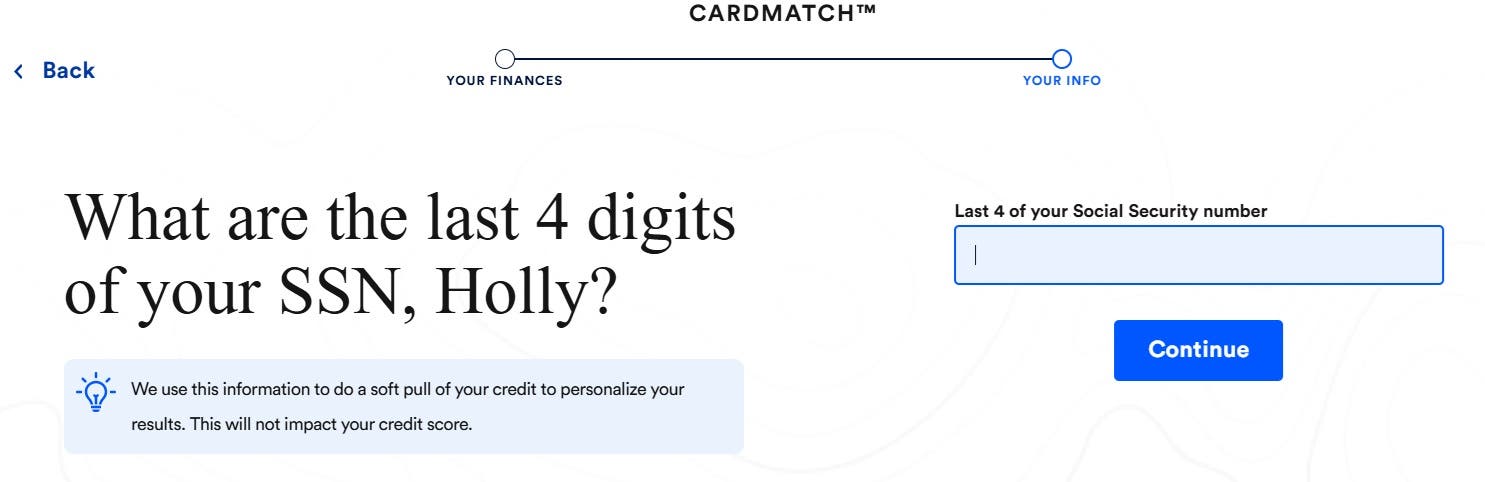

Next, you’ll enter some basic personal information to verify your identity. This includes your first and last name, your home address, the last four digits of your Social Security number (needed for the soft credit pull) and your email address.

EXPAND

From there, you’ll have the option to select “Agree and Get Matches.” By selecting this option, you agree to the terms and conditions and are ready to see your card matches.

Unfreeze your credit

Did you freeze your credit to protect against fraud? Remember to unfreeze it before using CardMatch. The tool can’t conduct the necessary soft credit pull if your credit is frozen. Instead of getting results that accurately reflect your credit card options, you may only see cards for people with no credit.

Types of offers you can find using CardMatch

CardMatch partners with a range of major credit card issuers, including Bank of America, Discover, Wells Fargo, American Express, Citi and Chase. Offers you can find are targeted to your individual profile, so they can vary dramatically from person to person.

You may find offers for some of the best travel and rewards credit cards if you use the tool, and they may even include more generous sign-up bonus offers than you can find elsewhere. You can also use CardMatch to connect with the best balance transfer offers on the market today.

Why should you use CardMatch?

CardMatch is a useful tool that can help you figure out the best card for you based on your credit score, your needs, the type of rewards you want to earn and other factors. Here’s a rundown of all the ways using CardMatch can help you get ahead.

- CardMatch helps you compare multiple credit cards all in one place: CardMatch shows you several cards you may be eligible for at once, which can make it easy to see how all your options compare.

- See which credit cards you’re likely to be approved for: With only a soft pull on your credit reports, CardMatch can show individual approval odds based on your credit score and other factors.

- Search for enhanced bonus offers: Because CardMatch offers are prescreened and tailored to each person’s credit profile, it can show users who meet certain criteria a range of targeted perks. This can include sign-up bonuses that are higher than the current public offers.

Keep in mind

Matching through CardMatch does not guarantee approval — it only shows whether you are likely to be approved if you take the steps to fully apply.

The bottom line

Since the CardMatch tool can match you with better credit card offers than you can find elsewhere on the web, it’s worth using any time you plan to apply for a new credit card. And since your offers could change over time, you might want to plan a day every few months to explore your options. Doing so could mean getting better bonus offers and more perks than you could otherwise, and the process only takes a few minutes.

Just remember that getting matched with a card through the tool isn’t the same as guaranteed approval for that card. CardMatch helps you gauge your approval odds for the best credit cards on the market today, but the issuer still has the final say in your application.

Frequently asked questions (FAQs)

Read the full article here