I’ve always used TurboTax to file my personal tax return. It’s what my dad showed me when I first started filing taxes, and I’ve used it ever since. I considered trying a free platform in previous years, but never actually made the jump.

This tax season was a whole new ball game. I started freelancing in May 2024, so this year was my first time filing as a self-employed person. I had a W-2 form from my previous employer (for two U.S. states), four 1099-NECs from freelance work and tax-related investment forrms to track down and factor in. I knew having multiple forms would drive up the total cost of TurboTax, so I decided to explore the IRS Free File options.

In the end, I filed my taxes for free with an IRS Free File program, but would I recommend it? Let’s find out.

TurboTax: My go-to choice

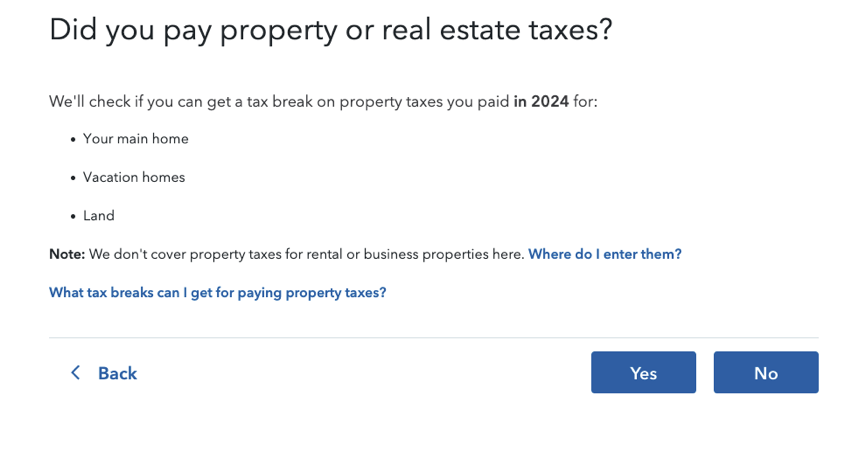

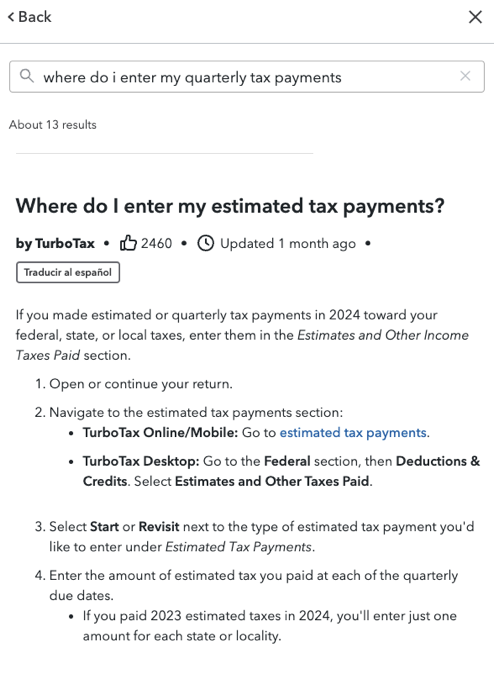

Bankrate ranked TurboTax as the best tax software for beginners in 2025, and I totally get why. The user-friendly design makes it simple to navigate by guiding you through each step and breaking down complicated tax jargon. You can access helpful resources without leaving the page by using the search feature or clicking on links within the questions. This feature makes it easier and faster to understand what you’re doing and keep moving through the steps without getting stuck.

One of my favorite features is TurboTax’s ability to automatically import tax documents from banks and employers. It saves time on entering the information, but it makes sense to double-check everything is correct just in case. I still had to manually enter my 1099-NEC forms, but it wasn’t too much of a hassle.

Another aspect I appreciate is how TurboTax constantly reassures you throughout the process. It checks for potential errors and gives confidence boosts that you’re on the right track and not missing anything.

While the helpful resources and ease of use are a huge plus, the cost is a big downside. TurboTax wanted to charge $267 after a limited-time $90 discount. The total would have been $357 without the early-bird discount, which is about 10 percent more expensive than the nationwide average cost of $323 for a tax return without itemized deductions, according to a National Society of Accountants study in 2021.

TurboTax is a solid choice for convenience, but the cost made me consider whether it was worth sticking with it or if a free option could get the job done just as smoothly.

TurboTax Pros

- Can import tax forms from banks and employers

- Offers flexible support options to file by yourself, receive live support or have an expert file taxes for you

- Provides helpful resources to help you answer questions

- Reviews your return for missing details and boosts confidence in the process

- Easy to use search bar to quickly find specific sections or resources

TurboTax Cons

- Expensive, especially for complex tax situations or multiple forms

- Upselling of add-ons can be annoying and costly

- Does not connect with all financial institutions

- Did not automatically ask about estimated tax payments

IRS Free File: Your wallet’s best friend

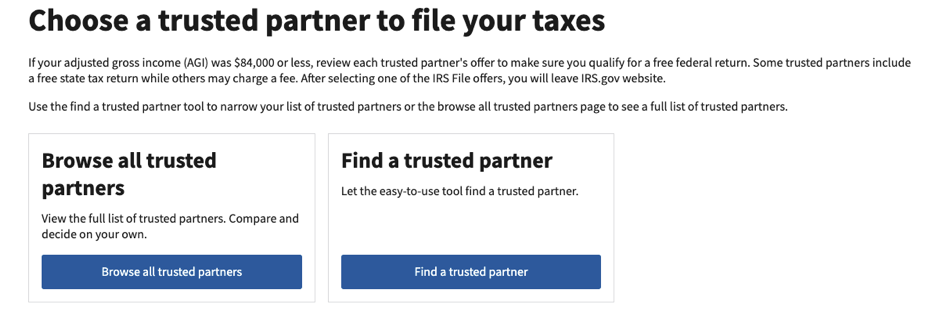

You can file your taxes without spending a dime by using IRS Free File. The catch is that you have to meet specific eligibility requirements. The program partners with tax software providers to offer a guided filing experience, but income limits and other criteria may limit your options.

For example, TaxSlayer is available if your adjusted gross income (AGI) is below $48,000, or under $84,000 for active military.

Some providers, like FreeTaxUSA, offer free state returns if you qualify for free federal filing, while others, like TaxAct, only provide free state returns in specific states. (Note: You must go through the IRS Free File site to access these companies’ Free File options.)

The IRS Free File program offers a quick survey to match you with the best partner for your tax situation. But be careful, you might choose a tax software you don’t qualify for if you don’t have accurate numbers or information. This error can lead to wasted time and having to redo your taxes (not that I’d know from experience or anything).

I chose 1040.com from the IRS Free File website because it was the only option for free state returns and eligibility based on my AGI. The site offers a similar guided experience to TurboTax by asking questions to determine which forms you need to fill out. However, the site has an older and less user-friendly feel than TurboTax. I did appreciate the supportive and encouraging copy — it kept me entertained.

Throughout the process, I kept second-guessing whether I was missing something or inputting information correctly. It also used more jargon than TurboTax, so I had to look up certain tax terms and figure out what numbers to enter.

While 1040.com saved me $267, it was more challenging than TurboTax to navigate and complete my return. Here are a few things to consider before choosing an IRS Free File program partner.

IRS Free File Pros

- Offers free federal and state tax return filing, depending on the platform

- 1040.com asks about estimated tax without needing to look it up

- Provides options for guided filing or manual input

IRS Free File Cons

- Limited eligibility and options based on AGI and location

- May require more tax knowledge or extra research time

- Some partners don’t connect to financial accounts to pull in forms

- Has an outdated interface, making it harder to navigate

TurboTax vs. IRS Free File experience

Filing a tax return as a self-employed worker is a learning experience, and I’ve picked up some tips that may make your return process easier.

First, it’s important to know which forms you need and what deductions or expenses you can claim. Bankrate’s tax deduction hub can help you there. While the guided experience on both platforms was helpful, it won’t always identify everything you qualify for or need to input.

For example, I made quarterly estimated tax payments throughout 2024. When I originally went through the process, TurboTax told me I owed thousands of dollars to the government. I knew that wasn’t true because I hadn’t entered anything about my quarterly payments. The search feature on TurboTax helped me find where to input this information. However, 1040.com asked me directly if I made quarterly payments.

The same experience happened on both sites when searching for where to add my car registration fees or SEP IRA contributions.

That leads to my second tip: Make a tax-filing checklist to ensure you don’t miss anything. The checklist should include all your income sources, expenses and any deductions you might qualify for.

If you have multiple clients, list each client and gather tax documents from each. You may have to track down a client or two, so starting early is a good idea.

While it took about the same amount of time to complete my tax return on each platform, I felt more confident using TurboTax.

Final thoughts

TurboTax is the clear winner in my eyes. Simplicity is king for a busy freelancer, so TurboTax’s beginner-friendly software makes handling self-employment taxes a breeze. Honestly, I don’t think I could have completed my return on 1040.com without using TurboTax first. I kept going back to my TurboTax information to see what forms and details I needed to include.

Plus, TurboTax works to improve its features for people like you and me. At the beginning of the process, it asked me questions about my experience and for feedback on what worked and what didn’t.

Even so, I filed with 1040.com since I used both platforms and found similar numbers for my return. I’d recommend trying out both platforms if you’re eligible. You don’t have to pay until you file, so these platforms won’t cost you anything other than time to input all your information and try it out. It helped me understand more about my taxes, so I’ll be better prepared next year and can improve how I track income and expenses.

The best tax software for you depends on your comfort level and preferences. If you’re like me and have always used TurboTax, it’s worth exploring other options to save money. But if cost isn’t a concern, keeping it simple might be the way to go. As the saying goes, “If it ain’t broke don’t fix it.”

Plus, tax preparation and software costs can be deducted as a business expense for self-employed individuals. So, even though TurboTax is pricier, you can write it off on your next tax return. As a frugal gal, I’m still curious about other free options. Will I give Cash App Taxes a try next year? Stay tuned.

Read the full article here