Key takeaways

- A boosted welcome bonus can greatly increase the value of a new credit card, making it a desirable perk for cardholders to seek out.

- There are several ways to potentially unlock a boosted welcome offer, such as checking for pre-approval offers or asking the issuer directly.

- It is important to carefully manage your spending and credit cards to avoid late payments or debt when trying to meet spending requirements for a welcome bonus.

I admit it: I can be tempted by flashy credit card bonus offers. Have you been there, too?

Maybe you’ve been thinking about applying for a new credit card and even done some research or asked your dad for his sound advice when — voilà — you get an email offering you a boosted welcome bonus on a card you were already considering, higher than the offer you saw online.

A higher welcome offer can be a powerful and lucrative reason to act, but how do you land one?

I found myself in this situation recently, wanting a new card but not quite ready to take the leap… until I landed a boosted welcome offer. Here’s what I learned and tips on how you can land one, too.

How I unlocked a 100,000-point welcome bonus with American Express

I started considering getting my first rewards credit card in the fall of 2024. I spent a lot of time on Bankrate’s CardMatch tool investigating which type of rewards card would work best for my spending habits and what I might qualify for.

The tool indicated I could likely qualify for the American Express® Gold Card with my current credit score. Plus, I liked that the Amex Gold’s rewards categories aligned with my regular spending at supermarkets and restaurants. After comparing it to several other desirable options, I ultimately agreed with the tool that the Amex Gold was my best option.

At the time, new Amex Gold cardholders could earn 60,000 Membership Rewards points after spending $6,000 in the first six months of opening the card. This was a strong offer to begin with since — according to Bankrate’s valuations — Membership Rewards points are worth an average of 2.0 cents each when transferred to a high-value travel partner, which put the welcome offer at about a $1,200 value.

I clicked on the CardMatch “Apply Now” button and headed to the American Express application page. Imagine my surprise when, instead of a 60,000-point offer, I saw a 100,000-point offer for the same spending requirement. A bonus on my expected bonus? Yes, please! The value of my potential welcome offer had just increased from about $1,200 to about $2,000, and I was not about to let it get away.

How you may be able to unlock a boosted welcome offer on your new credit card

Unlocking a boosted welcome offer often boils down to good luck and good timing. But there are several ways you can increase your chances of receiving this desirable perk. If you’ve been considering applying for a new credit card, you may want to consider trying one of these tricks to see if you can get that extra benefit.

Keep in mind:

Boosted welcome offers are not guaranteed and they may come with higher spending requirements. Credit card signup bonuses are just that — bonuses — so don’t rely on them as the sole factor when choosing a new card.

Use the Bankrate CardMatch tool

Bankrate’s CardMatch tool is a simple way to potentially unlock higher offers. Use the tool to compare several cards you may already be considering or to be prequalified with credit cards that align with your financial goals.

Because you’re going through a prequalification process — don’t worry, there’s no impact on your credit — issuers get a glimpse of your creditworthiness. With that information, they may decide to offer you an elevated offer when you apply through the tool.

CardMatch is a great starting point no matter where you are in your credit journey, but it could give you a nice boost if you’re lucky. This was definitely the case for me, as I applied for the Amex Gold through CardMatch and unlocked my 100,000-point bonus this way.

Learn more: Try out Bankrate’s Credit Card Comparison tool.

Check your pre-approval offers

This is one of the most common ways to find an increased credit card offer: Simply look through your email or snail mail! If you already have a credit card through one of the main issuers and a solid credit score, chances are you’ve been receiving new card offers for a while. But don’t toss them out — sometimes, these will include welcome offers or rewards rates that aren’t advertised online.

You can also search for these on your credit card issuer’s mobile app or website. Often, you’ll see your pre-approved new card or loan offers below your accounts on the homepage when you log in.

Take advantage of holiday and limited-time offers

Limited-time offers (LTOs) are also great ways to find a more desirable welcome bonus on a new card. Keeping track of when specific issuers tend to release their LTOs isn’t always possible, but can be a handy trick for acquiring one.

For example, Southwest Airlines has been known to promote boosted welcome offers for its credit cards during the early fall season, the most advantageous time to start working toward the highly-coveted Companion Pass. Patience may be key here, but watching for an excellent limited-time offer on a credit card may be the simplest and most efficient way to unlock one.

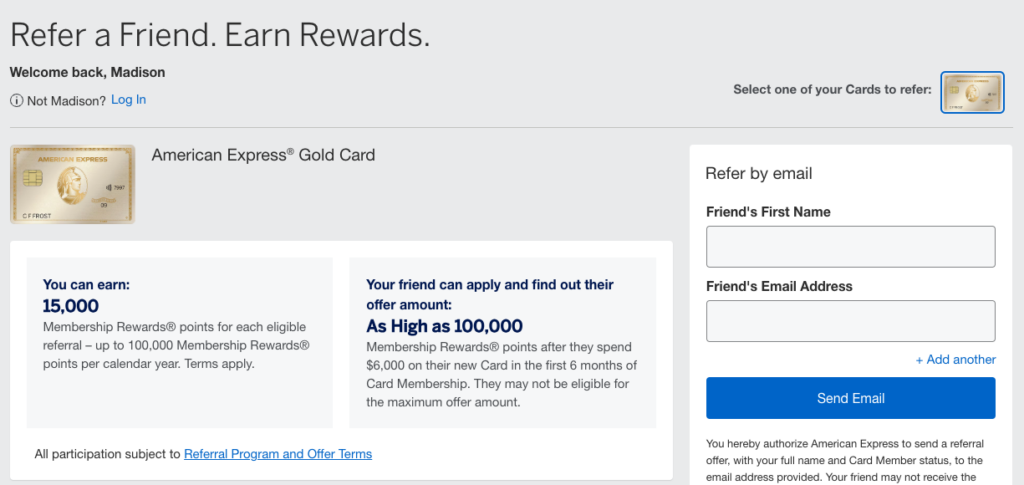

Get a referral link from friends and family

A referral link is often a win-win for you and your friends and family. Issuers are more likely to approve a new cardholder if they’ve been referred by an existing cardholder in good standing. When this happens, both cardholders get a little extra reward, and in the case of the new applicant, possibly a boosted welcome offer.

I’ve been considering going this route with my partner recently. We both love using my Amex Gold while grocery shopping or dining out together, so much so that he’s been eyeing the same card for himself to double our point-earnings opportunities. I know that if he ends up applying, I won’t hesitate to send a referral link his way beforehand and give us both the opportunity to rake in extra Membership Rewards points.

So, if you know someone who already has the same credit card you’re looking into, it may be worth asking if they’d send that referral link your way so you can both earn some extra rewards.

Call the issuer directly and ask

This may sound silly, but it never hurts to call an issuer directly and simply ask for a boosted welcome offer. Keep in mind the issuer will likely determine the answer based on your creditworthiness, such as if you carry any debt or have a good credit score. It can also be helpful if you already bank or have other cards with the issuer. If you think you have a strong case for asking for a boosted offer, it can’t hurt to try.

Top credit card bonuses

Although the best credit card welcome offers are constantly changing, here are some notable publicly available bonuses as of this writing. Remember, you may be able to score something even better:

- The Platinum Card® from American Express: This card is offering 80,000 Membership Rewards points if you spend $8,000 on qualifying purchases in the first six months of account opening.

- Capital One Venture Rewards Credit Card: The Capital One Venture Rewards is offering 75,000 bonus miles after spending $4,000 in the first three months of account opening. You can transfer these points to a hotel or airline transfer partner and never have to worry about them expiring.

- Wells Fargo Active Cash® Card: As for a cash rewards offer, the Wells Fargo Active Cash will reward you with a $200 cash rewards bonus after spending $500 on purchases within the first three months. This is a solid offer for a no-annual-fee card with a fairly low spending requirement.

The bottom line

Here’s the thing: A credit card’s welcome bonus, no matter how impressive, should not be the only reason you apply for a new credit card, especially if the card isn’t right for you or you have any debt looming over your head. But these offers can be excellent perks for when the card fits just right, and sometimes, you can receive boosted offers, making the rewards all the sweeter.

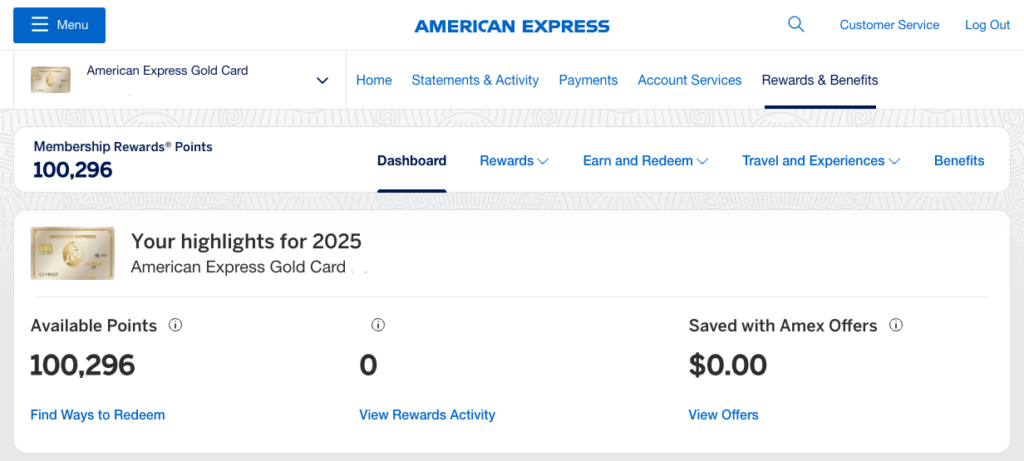

I would know. Fast-forward four months after my Amex Gold approval, and I’d responsibly hit the spending requirement to earn the welcome offer. One hundred thousand points loaded with possibilities sat in my account. Now, all I had to do was determine the best way to spend them.

I found a boosted offer for one of the best credit cards on the market through the Bankrate CardMatch tool. You, too, can use the tool, check your inbox for promotions or simply call the issuer and ask for a boosted offer. But the best way may simply be to keep your eyes peeled for targeted limited-time offers or ask a trusted friend if they’ll give you a referral.

Just remember to stay within your normal budget to hit that spending requirement. Having late payments or — even worse — debt will quickly offset those sparkly rewards.

Frequently asked questions about welcome bonuses

Read the full article here